Commercial boom fuels broker growth

Non-bank lenders and private capital are reshaping Australia’s commercial lending market as traditional banks tighten their grip

More

AUSTRALIA IS riding a wave of infrastructure investment, housing demand and access to credit that is opening new pathways for mortgage brokers seeking to diversify their revenue streams.

The latest Financial Stability Review from the Reserve Bank of Australia shows a strong appetite for commercial property is supporting credit access as competition among banks and non-banks heats up.

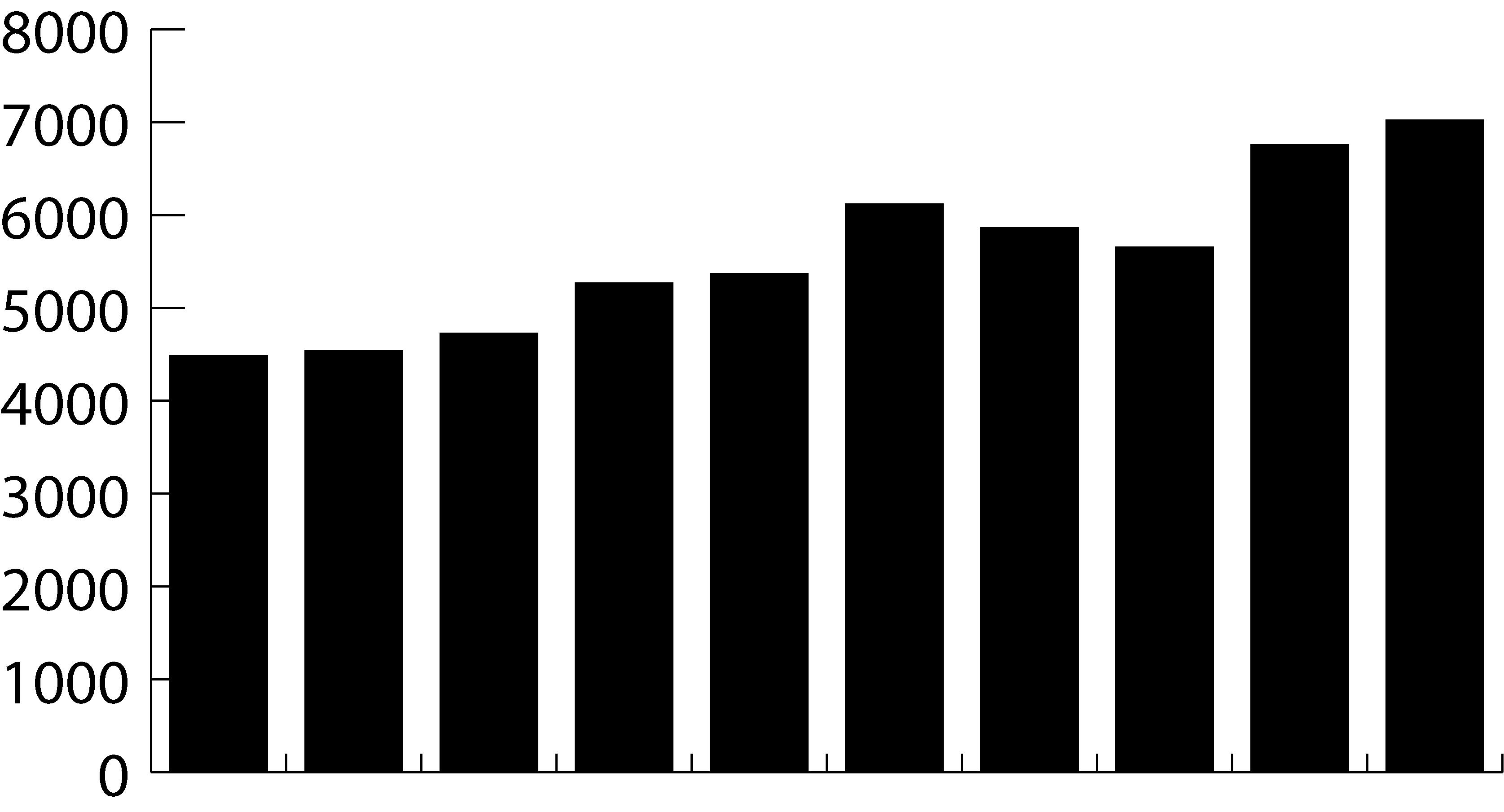

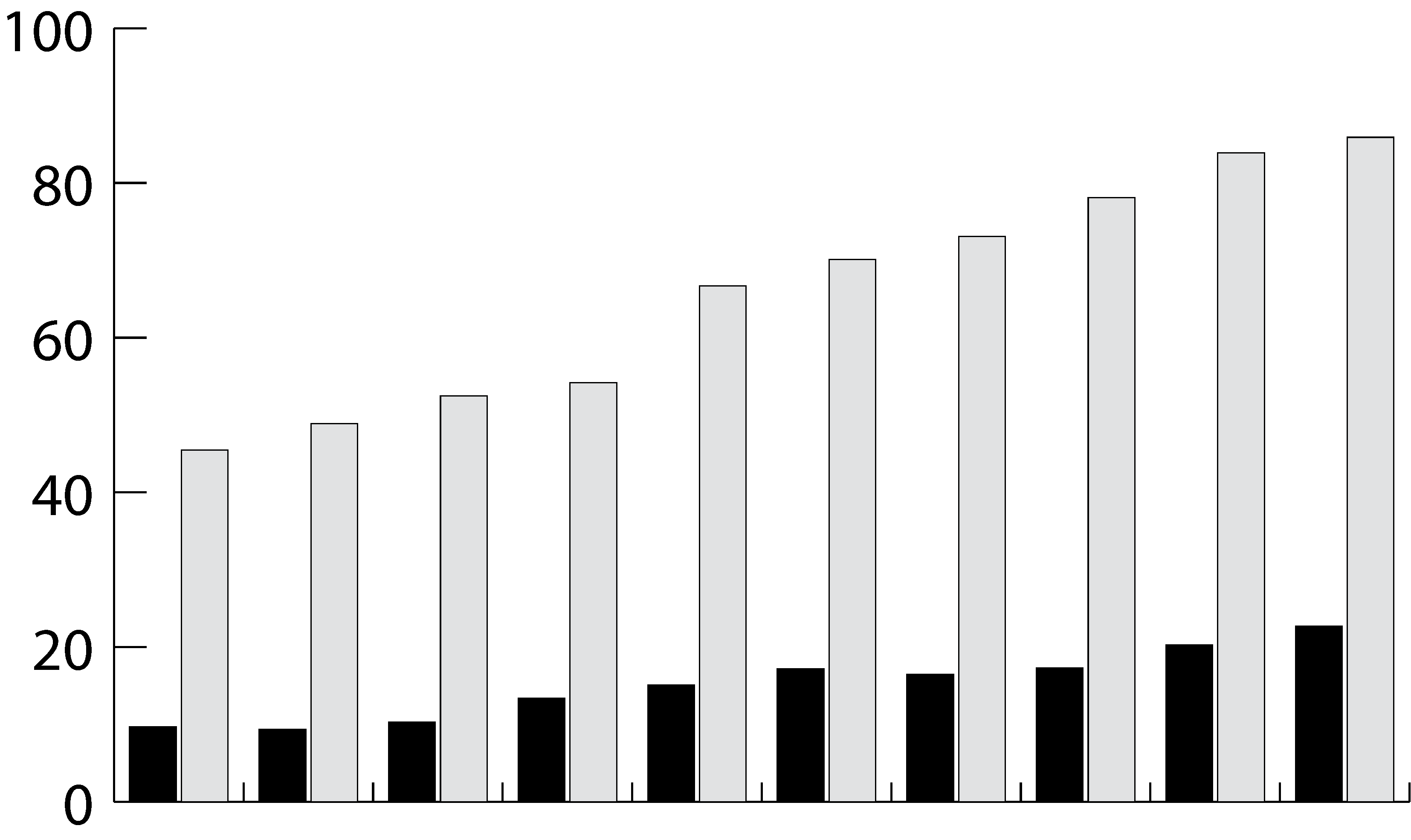

One key beneficiary of this competition is brokers, with the numbers telling a compelling story. A record 7,023 brokers wrote commercial loans in the six months to September 2024, representing a 24% jump from the corresponding six-month period in 2023. Settled loan values hit $22.69 billion, up 31% year-on-year, as businesses scrambled for capital to fund expansion and refinancing needs.

Banking institutions have boosted their activity in commercial lending through such measures as adjusting loans terms, but they are still constrained in this area. This has created space for non-bank lenders to expand their market share, offering faster decision-making and more tailored solutions for business borrowers.

“As traditional banks tighten their lending criteria in response to economic headwinds, non-bank lenders like Pallas Capital are seeing an influx of demand, particularly from developers and property investors seeking more flexibility and speed,” says Jason Arnold, group executive of origination at Pallas Capital.

Arnold notes that this shift in lending patterns is creating new opportunities for brokers who understand alternative financing options.

Other non-banks observe similar trends.

“While traditional banks remain active in commercial lending, regulatory constraints around credit and capital are limiting their flexibility,” says Ben Mckell, head of commercial lending at Brighten. The company represents a new breed of lender that has moved aggressively into the commercial space, capitalising on its reputation for speed and adaptability.

Non-bank lenders are particularly well-positioned to serve the growing demand for alternative documentation loans. Mckell notes that his organisation requires only one form of income verification, whether through an accountant’s declaration, six months of lodged business activity statements or six months of business bank statements.

The shift reflects changing borrower expectations. “Brokers are telling us that clients are increasingly looking for more flexibility and simplicity in the lending process,” Mckell explains. Brighten offers commercial loans with terms up to 30 years, loan-to-value ratios up to 80% and loan amounts up to $5 million.

Trilogy Funds has expanded its team across Brisbane, Sydney and Melbourne while investing in technology to improve transaction assessment speed and user-friendliness. “We’ve added a lot to our technology to provide better services to brokers in terms of our ability to assess a transaction quickly and effectively, making it more user-friendly for the brokers to work with our frameworks and our models,” Arentz says.

Successful commercial brokers need to develop expertise in areas that residential lending rarely touches. This includes understanding construction costs, zoning regulations, infrastructure impacts and the nuances of different property markets across Australia’s major cities and regional centres.

“To stay competitive, brokers need to go deep on product knowledge, particularly on the non-bank side where solutions can be more flexible but also more complex,” says Arnold. He emphasises that understanding how to structure deals to suit each lender’s credit appetite has become increasingly important in today’s market.

Arentz suggests that brokers should focus on backing quality operators rather than opportunistic developers. “What you’re looking for is a borrower who’s got discipline, who’s got market experience, who has financial acumen and analytical skills, who can understand how to assess project viability and has the necessary contacts and network,” he says.

Local market knowledge has become increasingly important as new development opportunities emerge in unexpected locations. Infrastructure projects, including regional hospitals in Queensland and transport networks in Sydney and Melbourne, are creating development opportunities in areas that were previously considered secondary markets.

The regulatory environment adds another layer of complexity. Different states operate under different approval systems, and brokers need to understand these variations to serve their clients effectively. Arentz points to NSW’s ICERT system as an example of how local knowledge can make the difference between a successful project and years of delays.

While artificial intelligence and automation are reshaping residential lending, the commercial sector remains heavily dependent on personal relationships and individual assessment. Mckell believes this will continue even as technology advances.

“AI is revolutionising residential lending, with machine learning and automation improving credit assessments, personalising financial products and streamlining processes,” he says. “But commercial lending is still a people business. Self-employed clients value personal connection, and brokers who build those relationships will be better positioned to future-proof their business as the age of AI dawns.”

Trilogy Funds provides commercial property development finance for brokers and property developers Australia-wide, going beyond traditional lenders by offering tailored, flexible and personalised solutions. With more than 20 years of experience financing projects across the residential, commercial, industrial and retail property sectors, we know what it takes to make projects successful. Trilogy Finance originated and manages loans of $3 million to $50 million with competitive rates and terms and has financed over $3.2 billion in projects over the last five years. We have funds ready to deploy with the support of a pooled mortgage trust worth over $970 million.

Find out more

In Partnership with

The current boom follows years of market turbulence that began with pandemic-era restrictions and stimulus measures. “There are a lot of factors in that sense,” says Clinton Arentz, head of lending at Trilogy Funds. “I mean, if you take a longer-term view, you’ve got the post-COVID recovery period, the government stimulus, but also the restrictions that came as a result of government intervention during COVID.”

The recovery has been uneven but increasingly robust. Employment levels remain exceptionally high, contributing to the Reserve Bank’s July decision to hold interest rates steady. Supply chains that were disrupted during the pandemic are now operating more smoothly, while the availability of capital, as well as skilled tradespeople, has improved markedly.

Arentz observes that the Australian economy is doing well in general. “We have a declining interest rate cycle ahead of us, and all of that turbulence that’s been caused by COVID and the restrictions and limitations around COVID are now freeing up. Supply chains are freeing up. Availability of capital is freeing up, availability of tradesmen is freeing up.”

The housing crisis has become a significant driver of commercial lending activity. Australia faces a chronic undersupply of residential properties, creating profitable opportunities for developers willing to tackle the challenge. This shortage has prompted new approaches to housing design and delivery, with developers experimenting with smaller units, shared spaces and different ownership models to improve affordability.

A recent KPMG report also cited continued demand for industrial property and a slight recovery for retail property as factors driving stronger commercial lending. The report showed bank loan exposures to commercial property as a share of total assets had risen to around 7% from levels consistently closer to 6% for most of the post-GFC period until 2023.

Industry experts

David Smith was appointed as Liberty’s chief distribution officer in January 2024. Strategy-driven with a customer-first ethos, Smith is responsible for the broader distribution platforms of the Liberty Financial Group, including its business partner relationships. Smith brings a wealth of knowledge and expertise to the company, having spent over

20 years in the financial services sector. He holds a Bachelor of Business (Hons) from Brunel University London and a Postgraduate Diploma in Marketing from the UK Chartered Institute of Marketing.

Liberty

David Smith

Share

Share

Share

Clinton Arentz

Trilogy Funds

Industry experts

Jason Arnold is the group executive of origination at Pallas Capital, responsible for strategic business growth. With over a decade of experience, he has been honoured with two MFAA Commercial Finance awards and consistently ranked among Australia’s top 10 commercial brokers for eight consecutive years by MPA magazine. Having originated and settled mortgages exceeding $1.4 billion, Arnold leverages his extensive knowledge to ensure wide distribution of Pallas Capital’s lending products through high-quality commercial loan introducers. His leadership drives Pallas Capital’s ongoing success by fostering growth opportunities and maintaining a prominent presence in the lending industry.

Pallas Capital

Jason Arnold

Clinton Arentz is managing director of Trilogy Finance and head of lending at Trilogy. Since joining the company in 2017, he has driven the growth of Trilogy’s property lending platform, expanding the Trilogy Monthly Income Trust to over $1 billion in construction loans. He also helped scale the Trilogy Industrial Property Trust to $250 million across five states. With 35-plus years in property development, Arentz has held senior roles at Jones Lang LaSalle and co-founded a BRW top-ranked company. He holds an MBA and executive credentials, delivering strategic finance solutions and long-term value for developers across residential, commercial and industrial sectors.

Trilogy Funds

Clinton Arentz

The expanding range of lenders and products has created both opportunities and challenges for mortgage brokers. Those who can master the diverse ecosystem of banks, non-banks and private lenders are finding new revenue streams, but the complexity requires additional skills and knowledge.

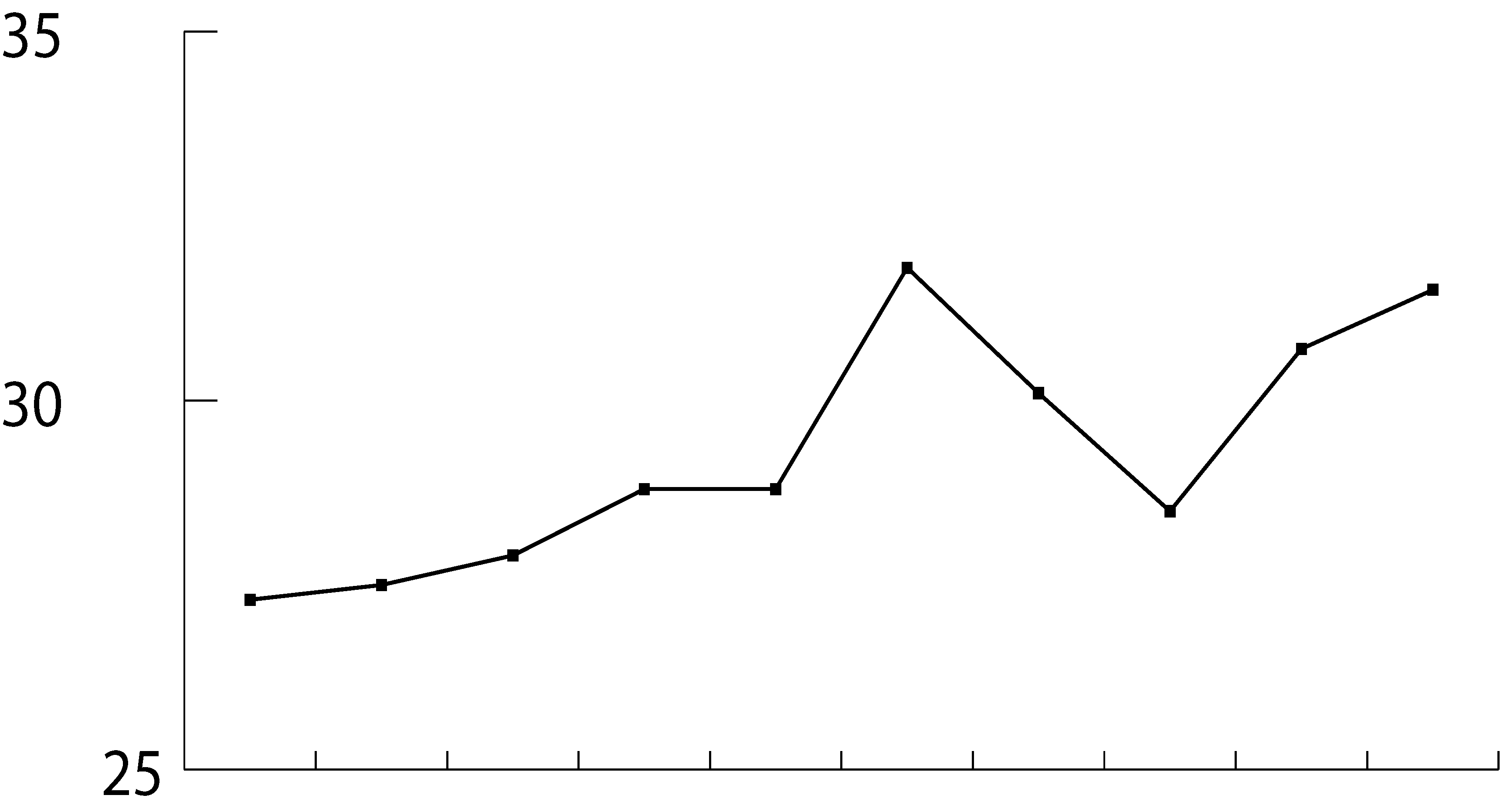

Pannek observes that 31.5% of mortgage brokers were writing commercial loans in the six months to September 2024, up from 30.7% in the previous period. “Brokers adept at leveraging this diverse lender ecosystem can better serve their clients,” she says.

Borrowers need brokers to get them over the line in the more nuanced world of commercial deals.

“Over the past year, we’ve seen commercial borrowers place a much bigger focus on speed and flexibility,” says Arnold. “More and more developers want to get started on construction without having presales or tenant commitments locked in.” This changing borrower behaviour is reshaping how brokers approach deal structuring and client relationships.

“It’s really all about confidence, says Mckell. “Brokers should remember they are trusted experts. If your client is entrusting you with their home or investment loan – pretty much their number one asset – they’re certainly going to trust you with their business and commercial lending needs.”

The key to success lies in understanding that commercial lending differs markedly from residential mortgages. Arentz emphasises that every commercial development transaction is unique, requiring brokers to develop expertise across multiple property types and market conditions.

“Commercial loans are different to residential loans, because residential loans are a bit set and forget, and the banks will just have a cookie-cutter model,” Arentz explains. “There’s really no two commercial development transactions the same.”

“SMEs need finance solutions tailored to variable cash flows and sector-specific demands, with growing interest in trade finance, equipment leasing and working capital facilities”

Anja Pannek, MFAA

The growth of private lending has added another layer to the market, and the RBA has noted that the role of non-bank lending in the commercial property space is expected to grow.

Anja Pannek, chief executive at the MFAA, notes that private lending options have expanded to serve businesses unable to meet traditional lending criteria. “Private lending and non-bank finance options have grown significantly, providing alternative capital sources for businesses unable to meet traditional lending criteria,” she says.

“SMEs need finance solutions tailored to variable cash flows and sector-specific demands, with growing interest in trade finance, equipment leasing and working capital facilities.”

Lenders are investing in technology to support broker relationships rather than replace them. Brighten’s Property Hub allows brokers to request valuation quotes and choose which ones to proceed with, giving them greater control over the process while maintaining the human element of relationship management.

Indeed, there is a wave of tech investment underway.

“We’ve invested heavily in technology and process improvements to make the lending experience faster, clearer and more reliable for brokers,” says Arnold, explaining that Pallas has developed systems that streamline everything from origination through to settlement while maintaining the human element that commercial clients value.

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

David Smith was appointed as Liberty’s chief distribution officer in January 2024. Strategy-driven with a customer-first ethos, Smith is responsible for the broader distribution platforms of the Liberty Financial Group, including its business partner relationships. Having spent over 20 years in the financial services sector, he brings a wealth of knowledge and expertise. Smith holds a Bachelor of Business (Hons) from Brunel University of London and a Postgraduate Diploma in Marketing from the UK Chartered Institute of Marketing.

Liberty

David Smith

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

“Brokers are telling us that clients are increasingly looking for more flexibility and simplicity in the lending process”

Ben Mckell, Brighten

The post-COVID recovery takes shape

Non-banks seize the moment

Published 25 Aug 2025

Jason Arnold

Pallas Capital

Brighten is an Australian owned, based and regulated non-bank lender with offices in Sydney, Melbourne, Brisbane, Hong Kong, Shanghai and Manila. Brighten is a full-service non-bank lender responsible for the origination, underwriting, servicing and funding of its mortgage portfolio. It has well-established warehouse-funding arrangements with multiple top-tier banks, three public RMBS programs and a wholesale credit fund to provide further funding diversification. Brighten offers a range of competitive full-doc, alt-doc, expat, non-resident, bridging, construction and commercial products to borrowers.

Find out more

Despite the positive market conditions, significant challenges remain. The biggest constraint on growth is not demand or capital availability but the speed of government approvals and administrative processes.

Arentz identifies planning approvals and completion certificates as major bottlenecks. “If there’s a limitation or a real drag in the system within Australia, it’s getting planning approvals and it’s getting completed approvals on completion of construction, when authorities have to come out and check off that everything’s been fitted well and in accordance with the relevant standards. Even down to the titling system, when titles are issued, there’s a massive amount of lag, both at the front end and the back end for local authorities,” he says.

The delays have worsened since COVID-19, with many local authorities operating with reduced staff or remote working arrangements. Projects face delays of months at both the approval and completion stages, increasing holding costs and preventing developers from rolling into their next projects.

Brokers embrace complexity

Technology meets relationships

Record number of brokers also writing commercial loans

Source: MFAA Industry Intelligence Service, 19th Edition

Industry experts

8,000

4,000

3,000

2,000

1,000

Oct 2019−

Mar 2020

Skills for the new market

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

Firms

People

Copyright © 2025 KM Business Information Australia Pty Ltd

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

People

Firms

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

0

Apr 2020−

Sep 2020

Oct 2020−

Mar 2021

Apr 2021−

Sep 2021

Oct 2021−

Mar 2022

Apr 2022−

Sep 2022

Oct 2022−

Mar 2023

Apr 2023−

Sep 2023

Oct 2023−

Mar 2024

Apr 2024−

Sep 2024

Proportion of total

Number of brokers

show/hide values

4,486

4,727

4,539

5,369

5,268

5,864

6,118

5,654

6,755

Source: MFAA Industry Intelligence Service, 19th Edition

Steady rise IN Mortgage brokers’ commercial loan book value

100

80

60

40

0

Oct 2019−

Mar 2020

Apr 2020−

Sep 2020

Oct 2020−

Mar 2021

Apr 2021−

Sep 2021

Oct 2021−

Mar 2022

Apr 2022−

Sep 2022

Oct 2022−

Mar 2023

Apr 2023−

Sep 2023

Oct 2023−

Mar 2024

Apr 2024−

Sep 2024

Total book value

Value settled

show/hide values

$bn

45.5

52.5

13.4

15.1

17.2

16.5

17.3

20.3

9.7

9.4

48.9

10.3

54.2

66.7

70.1

73.1

78.1

83.9

The bottleneck challenge

Professional development priorities

Brokers

Ben Mckell

Brighten

Anja Pannek

MFAA

As head of commercial lending at Brighten, Ben Mckell brings over two decades of experience across banking and non-bank finance, with deep expertise in commercial lending, business development and sales leadership. Before joining Brighten, he served as national sales manager, commercial at Pepper Money, where he led the growth of the non-bank’s commercial and SMSF lending channels. Mckell is known for building strong broker relationships, driving strategic partnerships and delivering tailored lending solutions that support business growth.

Brighten

Ben Mckell

MFAA CEO Anja Pannek is an experienced leader in the financial services sector and has a proven track record of leading successful businesses within the third party channel, including aggregator businesses and mortgage distribution for major financial services firms. She thrives in complex and uncertain environments and, through her vast experience in financial services, has an exceptionally strong understanding of the challenges and opportunities facing the Australian mortgage and finance broking industry.

MFAA

Anja Pannek

5,000

6,000

7,000

7,023

25

30

35

%

Pallas Capital specialises in the origination and investment management of structured debt and equity products, providing bespoke finance solutions to borrowers seeking reliable and competitive funding for commercial and residential assets and development projects. Pallas then offers financial investments in these loans to its investors, providing strong returns to its investor base through a range of risk-adjusted, property-backed debt and equity investment opportunities.

Find out more

20

22.7

85.9

Industry associations are responding to the growing commercial market by expanding education and training programs. “The MFAA supports brokers through training and education, from understanding the fundamentals to more micro-credential-based programs,” says Pannek.

“To support borrowers effectively, brokers need deep expertise in commercial finance and a broad lender panel,” she adds. The association’s National Equipment & Commercial Finance Forum brings together brokers, aggregators and lenders to share knowledge and identify emerging trends.

Arnold says, “Brokers need to understand the full spectrum of lending options available, especially the growing role of non-banks in today’s market.” He notes that commercial borrowers are relying on their broker to structure deals intelligently, identify potential risks early and guide them through the complexities of credit assessment and settlement.

“Over the past year, we’ve seen commercial borrowers place a much bigger focus on speed and flexibility. More and more developers want to get started on construction without having presales or tenant commitments locked in”

Jason Arnold, Pallas Capital

“Commercial loans are different to residential loans, because residential loans are a bit set and forget, and the banks will just have a cookie-cutter model. There’s really no two commercial development transactions the same”

Clinton Arentz, Trilogy Funds

Key skills include financial literacy for interpreting SME financials and cash flow, understanding diverse lending products with different risk profiles and approval processes, and managing compliance requirements across multiple lender types. Anti-money laundering obligations and responsible lending requirements add regulatory complexity that brokers must master.

Pannek emphasises that brokers must also develop skills in managing relationships with private lenders, which often have different expectations and processes compared to traditional institutional lenders. “Skills in navigating multiple lender policies, compliance requirements, managing relationships with lenders and dealing with complex client needs are increasingly important,” she says.

“Mastery of digital tools and technology will help improve the client experience and operational efficiency.”

Looking ahead, the commercial lending market appears set for continued growth, driven by the likelihood of falling interest rates and ongoing infrastructure investment.

“Construction, renewables and transport are contributing to strong business credit growth,” says Mckell.

Industrial assets, in particular, are likely to continue being viewed by lenders as safer investments.

“Industrial remains a standout opportunity, while office is showing more resilience than headlines suggest,” McKell says. “For clients with residential portfolios, commercial property can offer strong rental yields and valuable diversification.”

However, the regulatory environment will continue to evolve, with increased focus on environmental, social and governance (ESG) considerations. “Looking ahead, regulation and technology are two major forces reshaping commercial lending,” says Arnold. “We’re already seeing greater scrutiny around credit policies, responsible lending and risk assessment, and that’s only going to increase.”

It’s clear that brokers who understand regulatory frameworks will be better positioned to deliver value to their clients.

Future market directions

“The private lending sector’s growth continues to diversify options for borrowers but also increases the need for brokers to perform robust due diligence and compliance checks,” Pannek says, citing sectors such as construction and agriculture, as well as more regulatory focus on data privacy and responsible lending across the industry.

“Brokers will also increasingly be expected to deliver holistic services, requiring continuous upskilling and adaptability to this more complex lending environment,” says Pannek.

Technology will continue to improve processing speed and accuracy, but the relationship-based nature of commercial lending means personal connections will remain important.

The combination of strong business credit growth, expanding lender options and ongoing infrastructure investment creates conditions for sustained market expansion. For brokers willing to invest in developing commercial expertise, the opportunities are beckoning.

The Mortgage and Finance Association of Australia is the leading professional association for the mortgage and finance broking industry, with over 16,000 members. Our membership spans stakeholders from across the mortgage and finance industry. Over 97% of our members are mortgage and finance brokers. We also represent aggregators, lenders, mortgage managers, mortgage insurers and other suppliers to the industry. Our purpose is to empower our members to prosper and thrive, ensuring Australians benefit from competition and choice. We support our members and the industry through advocacy, education and promotion of the broker value proposition to consumers.

Find out more

27.3%

27.5%

27.9%

28.8%

28.8%

31.8%

30.1%

28.5%

30.7%

31.5%

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

Banking institutions have boosted their activity in commercial lending through such measures as adjusting loans terms, but they are still constrained in this area. This has created space for non-bank lenders to expand their market share, offering faster decision-making and more tailored solutions for business borrowers.

“As traditional banks tighten their lending criteria in response to economic headwinds, non-bank lenders like Pallas Capital are seeing an influx of demand, particularly from developers and property investors seeking more flexibility and speed,” says Jason Arnold, group executive of origination at Pallas Capital.

Arnold notes that this shift in lending patterns is creating new opportunities for brokers who understand alternative financing options.

Other non-banks observe similar trends.

“While traditional banks remain active in commercial lending, regulatory constraints around credit and capital are limiting their flexibility,” says Ben Mckell, head of commercial lending at Brighten. The company represents a new breed of lender that has moved aggressively into the commercial space, capitalising on its reputation for speed and adaptability.

Non-bank lenders are particularly well-positioned to serve the growing demand for alternative documentation loans. Mckell notes that his organisation requires only one form of income verification, whether through an accountant’s declaration, six months of lodged business activity statements or six months of business bank statements.

The shift reflects changing borrower expectations. “Brokers are telling us that clients are increasingly looking for more flexibility and simplicity in the lending process,” Mckell explains. Brighten offers commercial loans with terms up to 30 years, loan-to-value ratios up to 80% and loan amounts up to $5 million.

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

In Partnership with

Find out more