How brokers can branch out and find new growth

The ripest opportunities often hide beneath the surface. Brokers who look beyond home loans can pick up sweeter deals − and stronger client loyalty

More

IF YOU'VE ever been blueberry picking in the summer − especially at a pick-your-own farm − you’ll know that after the first wave of visitors strips the most obvious fruit, some of the best and juiciest berries are still there, just hidden in the shade or slightly out of reach.

Mortgage broking isn’t so different.

For brokers willing to look beyond the low-hanging fruit of residential home loans, there’s a whole layer of opportunity that remains underserved. Commercial lending, construction finance and solutions for self-employed borrowers have all grown steadily, offering new ways to deepen client relationships and build sustainable businesses. But tapping into these areas requires more than just ambition − it demands knowledge, confidence and support.

Competition in the broker channel has intensified as it captures an ever-larger share of new home loan originations. “If a broker doesn’t offer a full suite of products, their customer is likely to go to another broker who can help all types of borrowers and provide tailored solutions,” says Chris Meaker, head of sales and distribution at non-bank Brighten.

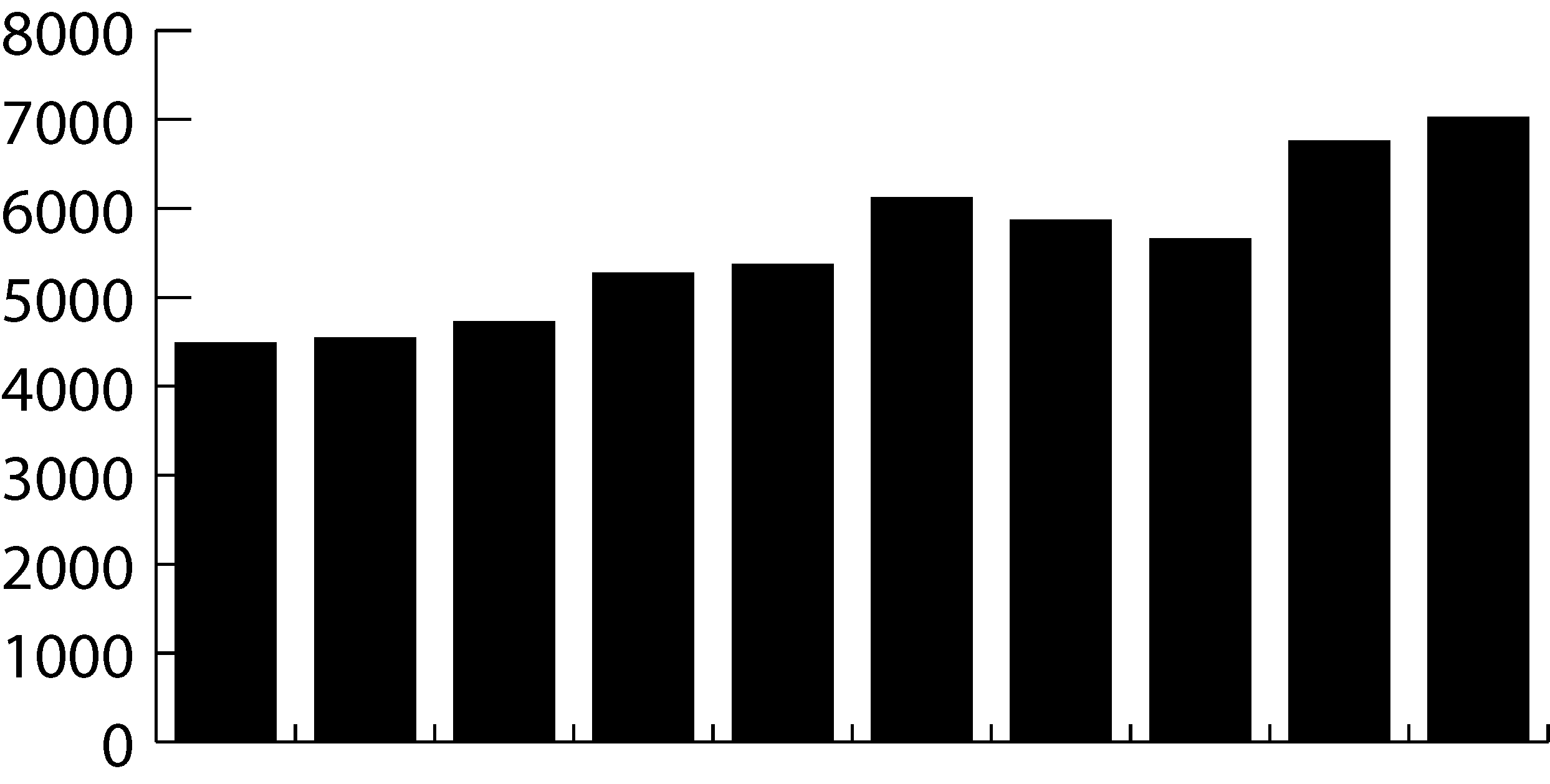

The numbers support this strategic shift. The MFAA’s latest research shows that both the volume and the loan book value of commercial lending by mortgage brokers have roughly doubled in the last five years. This expansion represents a structural change in how brokers position themselves in the market.

Diversification offers protection against market volatility and regulatory changes that affect specific lending segments. Smith explains the protective benefits: “Especially in uncertain economic times, having a broader offering helps brokers stay relevant and resilient.” This stability becomes increasingly valuable as economic cycles create challenges for single-product specialists.

The current economic environment, with its murky inflation outlook, interest rate uncertainty and weak business conditions in some sectors, particularly rewards brokers who can adapt their offerings to meet evolving client needs. Those who limit themselves to traditional residential lending risk being left behind as the market continues to evolve.

Direct access to specialist support teams has become standard practice among leading non-bank lenders. “Brokers have direct access to our BDMs, underwriters and support teams, and we’re always available to take a call and talk through a scenario,” Smith explains. This accessibility reduces the learning curve and builds broker confidence in unfamiliar product areas.

Similarly, Brighten provides comprehensive educational support. “At Brighten, we offer face-to-face support and webinars where brokers can tap into our dedicated sales team who have extensive knowledge of all markets, including residential, construction, expat, non-resident, bridging, commercial and short-term finance,” Meaker says.

As technology streamlines processes, the personal service element becomes more pronounced, with systems taking on more admin tasks. Meaker positions this as a strategic advantage, noting, “While AI chugs along in the background helping with routine number crunching, brokers can focus on adding value by positioning themselves even more as expert mentors who can guide their customers all the way through the homebuying process, from whoa to go.”

This evolution requires brokers to enhance their consultative skills while leveraging technology to handle the administrative burden. The combination creates capacity for deeper customer relationships while maintaining operational efficiency.

The construction and development sector presents particular opportunities for forward-thinking brokers. Meaker describes recent market movements: “We’ve seen a big shift in customers looking to build their ideal home. We recently launched a vacant land product to provide more solutions to these types of customers.”

Commercial lending represents another growth area where brokers can establish expertise. “When businesses are looking to grow, having a trusted expert in their corner who understands commercial finance can make all the difference,” Smith says. This specialisation prevents customer attrition to competitors while opening new revenue streams.

The self-employed borrower segment continues expanding as workplace flexibility increases. Products featuring alternative income verification methods address this growing market segment that traditional lenders often overlook.

As a leading Australian non-bank lender, Liberty offers innovative solutions at competitive prices to support customers with greater choice. Over the past 25-plus years, this free-thinking approach to loan solutions has seen more than 700,000 customers get financial across a wide range of home, car, personal and business loans, as well as SMSF lending and insurance products. Liberty remains the only non-bank lender with an investment-grade credit rating offering custom and prime solutions to help more people get financial.

Find out more

In Partnership with

Australian borrowers today expect more from their financial advisers than ever before. “Borrowers are increasingly seeking holistic solutions,” says David Smith, chief distribution officer at non-bank Liberty. “So, rather than only working with them on a single loan, there are opportunities to support them across different life stages.” The relationship goes beyond settlement and evolves as clients start businesses, renovate homes or pursue investment opportunities.

This shift reflects broader changes in how Australians work and live. Pointing to emerging trends, Smith notes, “We’re seeing strong momentum in commercial lending and solutions for self-employed borrowers who may not fit the traditional lending mould.” The rise of flexible employment arrangements has created demand for products that traditional banks often find difficult to accommodate.

David Smith

Liberty

Industry experts

David Smith was appointed as Liberty’s chief distribution officer in January 2024. Strategy-driven with a customer-first ethos, Smith is responsible for the broader distribution platforms of the Liberty Financial Group, including its business partner relationships. Smith brings a wealth of knowledge and expertise to the company, having spent over

20 years in the financial services sector. He holds a Bachelor of Business (Hons) from Brunel University London and a Postgraduate Diploma in Marketing from the UK Chartered Institute of Marketing.

Liberty

David Smith

Share

Share

Share

Chris Meaker

Brighten

Industry experts

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

David Smith was appointed as Liberty’s chief distribution officer in January 2024. Strategy-driven with a customer-first ethos, Smith is responsible for the broader distribution platforms of the Liberty Financial Group, including its business partner relationships. Having spent over 20 years in the financial services sector, he brings a wealth of knowledge and expertise. Smith holds a Bachelor of Business (Hons) from Brunel University of London and a Postgraduate Diploma in Marketing from the UK Chartered Institute of Marketing.

Liberty

David Smith

The role of artificial intelligence and automation in mortgage broking generates significant discussion across the industry. Rather than viewing technology as a threat, successful brokers are learning to leverage it strategically. “With manual tasks becoming more efficient, brokers can spend more time engaging with customers and delivering a meaningful service that customers truly value,” Smith says.

Meaker offers a broader perspective on this technological shift. “A broker’s role is about so much more than just running an algorithm and picking the lowest number,” he says. “It’s about managing relationships, nurturing customers and acting as a conduit between the borrower and the lender.” The human element becomes more valuable as routine tasks become automated.

Technology platforms now enable brokers to access diverse product sets more easily than in the past. Training programs, webinars and direct access to specialist teams help brokers navigate new territory with confidence.

“A broker’s role is about so much more than just running an algorithm and picking the lowest number. It’s about managing relationships, nurturing customers and acting as a conduit between the borrower and the lender”

CHRIS MEAKER,

BRIGHTEN

But despite the clear benefits, many brokers remain hesitant to expand their offerings. Smith identifies the primary obstacle: “One of the biggest hurdles is the perception that diversification is too complex.” This fear often stems from brokers’ comfort with familiar products and processes.

However, Meaker says the idea that offering a commercial solution is harder or more complex than residential is plain wrong. “That isn’t the case,” he states, “and often it can be easier, with less income constraints. If a broker is submitting residential applications, it’s no harder to provide commercial solutions for the same customer. This can also be said for offering alt-doc loans, short-term finance and bridging loans or offering expat and non-residential solutions.”

The administrative burden that deters many brokers may be less significant than anticipated. Both lenders emphasise the importance of support systems in overcoming these barriers. “There’s nothing really to stop brokers. It’s more about education and working closely with our BDM team to expand their knowledge and help their customer base,” Meaker explains.

Successful diversification requires more than simply adding products to a portfolio. Smith emphasises the strategic approach: “It starts with taking the time to understand where they want to diversify.” Brokers must assess their existing client base, identify natural extension opportunities and build expertise systematically.

Customer retention improves significantly when brokers can offer comprehensive solutions. “If you diversify and offer a customer a solution that not all brokers can offer, I am confident you will get their next residential or investment loan,” Meaker says. This creates a compounding effect where initial diversification efforts generate long-term relationship benefits.

Standing out in a crowded market requires more than competitive rates. “With the broker channel writing the majority of new home loans, standing out in the market matters, and a diversified offering can be a major point of difference,” Smith observes. This differentiation becomes particularly valuable during economic uncertainty.

Meaker reinforces this point: “Offering multiple solutions will enhance your reputation and you'll become a one-stop shop for your customer.” The convenience factor resonates strongly with time-pressed borrowers who prefer dealing with fewer service providers.

The relationship-building aspect cannot be understated. When brokers can support clients through various life stages and business cycles, they transition from transactional service providers to trusted advisers. This shift protects against commoditisation and builds sustainable competitive advantages.

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

David Smith was appointed as Liberty’s chief distribution officer in January 2024. Strategy-driven with a customer-first ethos, Smith is responsible for the broader distribution platforms of the Liberty Financial Group, including its business partner relationships. Having spent over 20 years in the financial services sector, he brings a wealth of knowledge and expertise. Smith holds a Bachelor of Business (Hons) from Brunel University of London and a Postgraduate Diploma in Marketing from the UK Chartered Institute of Marketing.

Liberty

David Smith

Chris Meaker

Brighten

Chris Meaker is head of sales and distribution at Brighten. He has over 21 years of experience in the finance industry, with a focus on lending, business development and sales management. Prior to joining Brighten, Meaker worked for La Trobe Financial, where he was an executive general manager and head of origination channels. Previously, he worked for Pepper Financial Services Group as state manager and senior business development manager. He holds a diploma in finance and mortgage broking.

Brighten

Chris Meaker

“Borrowers are increasingly seeking holistic solutions. So, rather than only working with them on a single loan, there are opportunities to support them across different life stages”

DAVID SMITH,

LIBERTY

The case for expansion

Market pressures drive change

Published 28 Jul 2025

David Smith

Liberty

Brighten is an Australian owned, based and regulated non-bank lender with offices in Sydney, Melbourne, Brisbane, Hong Kong, Shanghai and Manila. Brighten is a full-service non-bank lender, responsible for the origination, underwriting, servicing and funding of its mortgage portfolio. It has well-established warehouse-funding arrangements with multiple top-tier banks, three public RMBS programs and a wholesale credit fund to provide further funding diversification. Brighten offers a range of competitive full-doc, alt-doc, expat, non-resident, bridging, construction and commercial products to borrowers.

Find out more

Customer retention forms the backbone of successful diversification strategies. The investment in expanding product knowledge pays dividends through sustained client relationships. “Customers never leave when you provide good service,” Meaker asserts, highlighting the loyalty that comprehensive service generates.

Smith reinforces this customer-centric approach, noting, “Really listening to the needs of customers and having great communication will always put brokers above the pack.” When combined with diverse product offerings, this creates what he describes as “a holistic customer experience”.

The financial benefits extend beyond immediate transaction fees. Brokers who successfully diversify report improved margins and more stable income streams as they capture multiple touchpoints throughout their clients’ financial journeys.

With the right support, education and tools, brokers can look beyond the familiar and tap into new pockets of opportunity − whether that’s commercial lending, construction finance or solutions for self-employed clients. Much like the best fruit left hidden among the leaves, these markets reward those prepared to search a little deeper and broaden their approach.

In blueberry picking − and in broking − the sweetest results often come to those who take the time to look beyond the surface and explore new opportunities.

Technology as enabler, not replacement

Building sustainable, competitive practices

Value of commercial loans settled by mortgage brokers

Source: MFAA Industry Intelligence Service, 19th Edition

Industry experts

100

80

60

40

20

Oct 2019−

Mar 2020

Specialisation opportunities

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

Firms

People

Copyright © 2025 KM Business Information Australia Pty Ltd

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

People

Firms

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

0

Apr 2020−

Sep 2020

Oct 2020−

Mar 2021

Apr 2021−

Sep 2021

Oct 2021−

Mar 2022

Apr 2022−

Sep 2022

Oct 2022−

Mar 2023

Apr 2023−

Sep 2023

Oct 2023−

Mar 2024

Apr 2024−

Sep 2024

Total book value in period

Value settled in period

show/hide values

9.69

45.46

9.37

48.91

10.27

52.50

13.40

54.19

15.10

66.71

17.23

70.06

17.29

78.12

16.49

73.11

20.31

83.92

22.69

85.90

Source: MFAA Industry Intelligence Service, 19th Edition

BROKERS ALSO WRITING

COMMERCIAL LOANS

8,000

6,000

4,000

2,000

0

4,486

Oct 2019−

Mar 2020

Apr 2020−

Sep 2020

Oct 2020−

Mar 2021

Apr 2021−

Sep 2021

Oct 2021−

Mar 2022

Apr 2022−

Sep 2022

Oct 2022−

Mar 2023

Apr 2023−

Sep 2023

Oct 2023−

Mar 2024

Apr 2024−

Sep 2024

Proportion of total

Number of brokers

show/hide values

35

30

25

%

Brokers

4,539

4,727

5,268

5,369

6,118

5,864

5,654

6,755

7,023

27.3%

27.5%

27.9%

28.8%

28.8%

31.8%

30.1%

28.5%

30.7%

31.5%

A buffer against economic choppiness

Long-term relationship building

$bn

DAVID SMITH,

LIBERTY

“Borrowers are increasingly seeking holistic solutions. So, rather than only working with them on a single loan, there are opportunities to support them across different life stages”

As a leading Australian non-bank lender, Liberty offers innovative solutions at competitive prices to support customers with greater choice. Over the past 25-plus years, this free-thinking approach to loan solutions has seen more than 700,000 customers get financial across a wide range of home, car, personal and business loans, as well as SMSF lending and insurance products. Liberty remains the only non-bank lender with an investment-grade credit rating offering custom and prime solutions to help more people get financial.

Find out more