SMSF lending enters the next stage

Once niche and complex, self-managed superannuation fund lending has matured into a trillion-dollar sector. Brokers must keep up as demographics, regulations, property focus and non-bank lenders reshape the market

More

WHEN SELF-MANAGED superannuation funds first dipped into property loans, the space was seen as the domain of wealthy boomers chasing bricks and mortar. A decade later, the market has ballooned into a billion-dollar industry – and it’s no longer just retirees signing the paperwork.

With over 653,000 SMSF funds now managing more than a trillion dollars in assets, the space has matured beyond its early reputation as the preserve of property-obsessed baby boomers.

A new generation of Gen X and millennial trustees – coming in with more sizeable super balances at an earlier age, thanks to compulsory super – are reshaping SMSF lending. Their appetite for flexibility, digital service and active financial management is forcing brokers to rethink old playbooks. What was once a niche product is now a growth engine for non-bank lenders – and a test of how quickly brokers can adapt to a complex but lucrative corner of finance.

The shift is reflected in the numbers. Gen X and millennial investors are now making up nearly 80% of newly established SMSFs, with about 10% under age 35. These investors bring different expectations to the table.

“They expect greater flexibility, digital access and fast decisions,” says Barry Saoud, chief executive of mortgages and commercial lending at Pepper Money. “In response, we’ve supercharged our SMSF lending offering to corporate trustees to meet those expectations.”

Saoud points to recent changes at Pepper Money that reflect this generational shift. “Pepper Money now allows corporate trustee SMSF real estate lending clients to borrow at up to 90% LVR with no risk fees, which could help SMSFs get into the property market with just a 10% deposit, plus stamp duty and conveyancing costs, and potentially save their super fund thousands in risk fees,” he says.

This generational shift has practical implications for brokers. Younger trustees often come with different risk profiles, income patterns and expectations about service delivery that require a more flexible approach than the traditional SMSF playbook.

One example is Pepper Money’s introduction of an SMSF pre-approval facility. “We introduced an SMSF pre-approval facility to quickly show what a corporate trustee SMSF could borrow – a feature that’s rare in this space – which caters to the instant-information mindset,” Saoud says.

To achieve success in SMSF lending, brokers need to work more closely with other professionals than required for most other lending types.

“Through our broker education series we highlight the importance of a mortgage broker focusing on providing credit advice and not overstepping the mark into financial advice,” Chesworth says. “And we strongly encourage the broker to work closely with the customers and other professionals such as their accountant, financial adviser and solicitor or conveyancer to ensure the customer receives the appropriate support throughout the acquisition and lending process.”

This collaborative approach serves multiple purposes beyond risk management. It positions brokers as part of a professional team rather than just as transaction facilitators, potentially generating referral opportunities and strengthening client relationships.

The stakes are high when compliance fails. “The SMSF retains its complying status, as in instances this is removed, for example, if the annual returns aren’t lodged in time,” Chesworth says.

The pre-approval process serves a risk management function, Saoud explains. “Our SMSF pre-approval process helps brokers and clients understand their borrowing limit up front, helping them avoid overcommitting or misjudging serviceability. It’s a simple way to bring clarity and confidence to the process,” he says.

“We support brokers from the very start with the right tools, guidance and guardrails. Education is key –before a deal even begins, we provide checklists and training that provide useful guidelines.”

However, Saoud is clear about where lender responsibilities end: “That said, we can’t give legal, financial or tax advice, but we can help make sure everything’s in place for settlement. It’s not the lender or the broker’s role to confirm compliance with SMSF requirements. That responsibility sits with the SMSF itself. The SMSF members must seek independent legal, financial and tax advice to ensure they’re meeting their obligations.”

Regulatory scrutiny is also increasing. “The ATO is tightening oversight, especially around property lending,” says Saoud. “If additional requirements are implemented, we’ll quickly build them into our process without disruption.”

Superannuation is an important aspect of everyone’s retirement savings, and while it’s not compulsory, it’s always recommended that people seek financial advice around their superannuation and whether an SMSF is suitable for them.

Despite periodic speculation about SMSFs diversifying into other asset classes, property continues to dominate limited recourse borrowing arrangements. The numbers tell a clear story about trustee preferences and market behaviour.

LRBAs grew by 5% to $70.53 billion over the year to end June, indicating continued demand for property and asset acquisition via non-bank finance.

“Of the total assets owned through an LRBA, 97% is related to real property, which is a split of approximately 55% residential property and 42% non-residential property,” Chesworth says.

The concentration is even more pronounced when examining individual fund behaviour, with 86% of funds holding just one property and only 8.8% holding two properties.

The property dominance continues, but within that category, preferences are shifting. “It’s safe to say property in all its forms is king in SMSF lending,” Saoud says. “Residential property remains popular, but we’re seeing more interest in commercial assets – often to lease to their own business.”

In Partnership with

The demographic makeup of SMSF trustees is shifting in ways that challenge traditional assumptions about who uses these vehicles. “Since mandatory super contributions were introduced in 1992, we’re seeing Gen X and millennials having a more sizeable super balance at an earlier age compared to previous generations, as it’s been a forced savings for most their working life,” says Richard Chesworth, head of specialised distribution at Bluestone Home Loans.

Technology has become the great enabler for younger trustees who expect the same digital sophistication from their super that they get from their banking apps. “We’ve also seen technology play a critical role in making SMSFs more accessible to younger generations, and they are increasingly taking an active role in managing all aspects of their finances,” Chesworth says.

Jason Azzopardi has over 25 years of experience in finance in both Australia and London. Prior to joining Brighten as CEO, Azzopardi was the CFO at ASX-listed non-bank lender Resimac, concurrently holding additional roles that included leading Resimac’s Manila operations and managing Resimac NZ as CEO. Previously, he held key senior roles at Bankwest, Macquarie Bank and within private equity in the UK, namely at Fortress and 3i. Azzopardi is a respected financial services leader who has successfully implemented strategic initiatives across multiple disciplines, including finance, treasury, distribution, operations, data and business intelligence, brand and customer experience. Azzopardi is a fellow of CPA Australia and a graduate of the Australian Institute of Company Directors.

Brighten

Jason Azzopardi

Share

Share

Share

Richard Chesworth

Bluestone Home Loans

Industry experts

Barry Saoud joined Pepper Money in July 2021 as general manager, mortgages and commercial lending and is responsible for its strategic direction and operating performance across sales, product, credit and operations functions for Australia and New Zealand mortgages, commercial loans, personal loans and direct sales. With over two decades’ experience in financial services, Saoud has held numerous roles across areas ranging from legal to company secretary, sales and product management at the likes of Aussie (Home Loans), GE Capital, HSBC and Norton Rose Fulbright. He is a passionate leader with proven ability to grow businesses and exceed targets.

Pepper Money

Barry Saoud

With a passion for all things SMSF lending, head of specialised distribution Richard Chesworth has been involved in the space since the introduction of LRBAs in 2007. With over 30 years in the industry, Chesworth is an authoritative voice on SMSF lending in Australia and works directly with brokers, accountants and financial planners to support them through the opportunities and regulations of the sector.

Bluestone Home Loans

Richard Chesworth

SMSF lending remains one of the more technically demanding areas of mortgage broking, with regulatory pitfalls that can derail transactions. The ATO’s oversight creates a web of requirements that trustees and their advisers must handle correctly.

“There’s a complex framework of regulations and compliance structure required by the ATO as regulator that SMSF trustees must adhere to,” Chesworth explains. The challenges range from basic structural issues to more technical compliance matters that can trip up even experienced practitioners.

Common problems include trust deeds that don’t properly reflect the true entities involved, properties acquired in the wrong entity name, and confusion around single acquirable asset rules, Chesworth adds. “Key areas where we’re seeing SMSF trustee issues include acquiring the property in the wrong entity as they sign a contract in the SMSF trustee’s name, however the SMSF only acquires beneficial ownership, and contracts should be executed in the bare trustee’s name.”

“The younger SMSF demographic wants control, speed and flexibility, and as a non-bank lender we’ve been quick to adapt our products to tick those boxes”

BARRY SAOUD,

PEPPER MONEY

While more borrowers are getting into SMSF, brokers themselves can be reticent about the product due to its reputation for being complex.

“The main issue we see from a broker perspective is apprehension around the product,” says Chesworth. “While many brokers are conscious of the unique regulatory framework required for SMSF lending, some feel this is too much of a hurdle to get started.”

He encourages brokers to remember their early forays into the world of lending. “What I say to these brokers is, think back. You would have thought your first home loan was a hurdle, but you got through. Your first investment loan was probably interesting too, but now these types of transactions become second nature. It’s exactly the same with SMSF lending.”

His advice draws on the universal broker experience of mastering new product types. “Once you understand the framework you’re working within, navigating this becomes easier with each subsequent deal.”

For brokers new to SMSF lending, the technical requirements can seem overwhelming. The regulatory framework, while not impossibly complex, requires a different approach from standard residential or investment lending.

“SMSF lending is a segment I’m incredibly passionate about, and we’re here to help brokers through every single step of the way,” Chesworth says. “Our approach is firstly to demystify what SMSF lending is about, through helping them understand the structures and what they achieve for the SMSF while also supporting the legislation.”

Building broker confidence is a priority across the sector. Saoud says, “Building broker confidence in SMSF lending is something we’re passionate about, because we know a confident broker is an effective broker.”

The trend speaks to a more active approach to super management. “Our flexible lending policies, including higher LVRs and broader asset acceptance, support this trend and open up more opportunities for SMSFs to diversify. Trustees are embracing property like never before, using their super not just to save but to build income and even support their own businesses,” Saoud says.

This focus hasn’t created the market distortion that some critics feared. SMSF investment in residential property represents just 0.8% of the total Australian residential property market, according to ATO data, making it a significant factor for lenders and brokers rather than a systemic market influence.

The maturity of the sector has brought changes in trustee behaviour, with refinancing becoming more common as trustees move away from set-and-forget approaches. This shift towards active management creates ongoing opportunities for brokers to maintain client relationships beyond the initial transaction.

Cory Bannister is senior vice president and chief lending officer at La Trobe Financial. Bannister has over 20 years’ experience in financial services and has held a number of positions across credit and distribution since joining the business in 2000. As CLO, Bannister is focused on managing substantial wholesale and retail investors. He holds diplomas in mortgage lending and business accounting and resides in Melbourne.

La Trobe Financial

Cory Bannister

Jason Azzopardi has over 25 years of experience in finance in both Australia and London. Prior to joining Brighten as CEO, Azzopardi was the CFO at ASX-listed non-bank lender Resimac, concurrently holding additional roles that included leading Resimac’s Manila operations and managing Resimac NZ as CEO. Previously, he held key senior roles at Bankwest, Macquarie Bank and within private equity in the UK, namely at Fortress and 3i. Azzopardi is a respected financial services leader who has successfully implemented strategic initiatives across multiple disciplines, including finance, treasury, distribution, operations, data and business intelligence, brand and customer experience. Azzopardi is a fellow of CPA Australia and a graduate of the Australian Institute of Company Directors.

Brighten

Jason Azzopardi

“SMSF lending is a segment I’m incredibly passionate about, and we’re here to help brokers through every single step of the way”

RICHARD CHESWORTH, BLUESTONE HOME LOANS

The new guard

Breaking down barriers

Published 20 Oct 2025

Barry Saoud

Pepper Money

The compliance minefield

The non-bank advantage

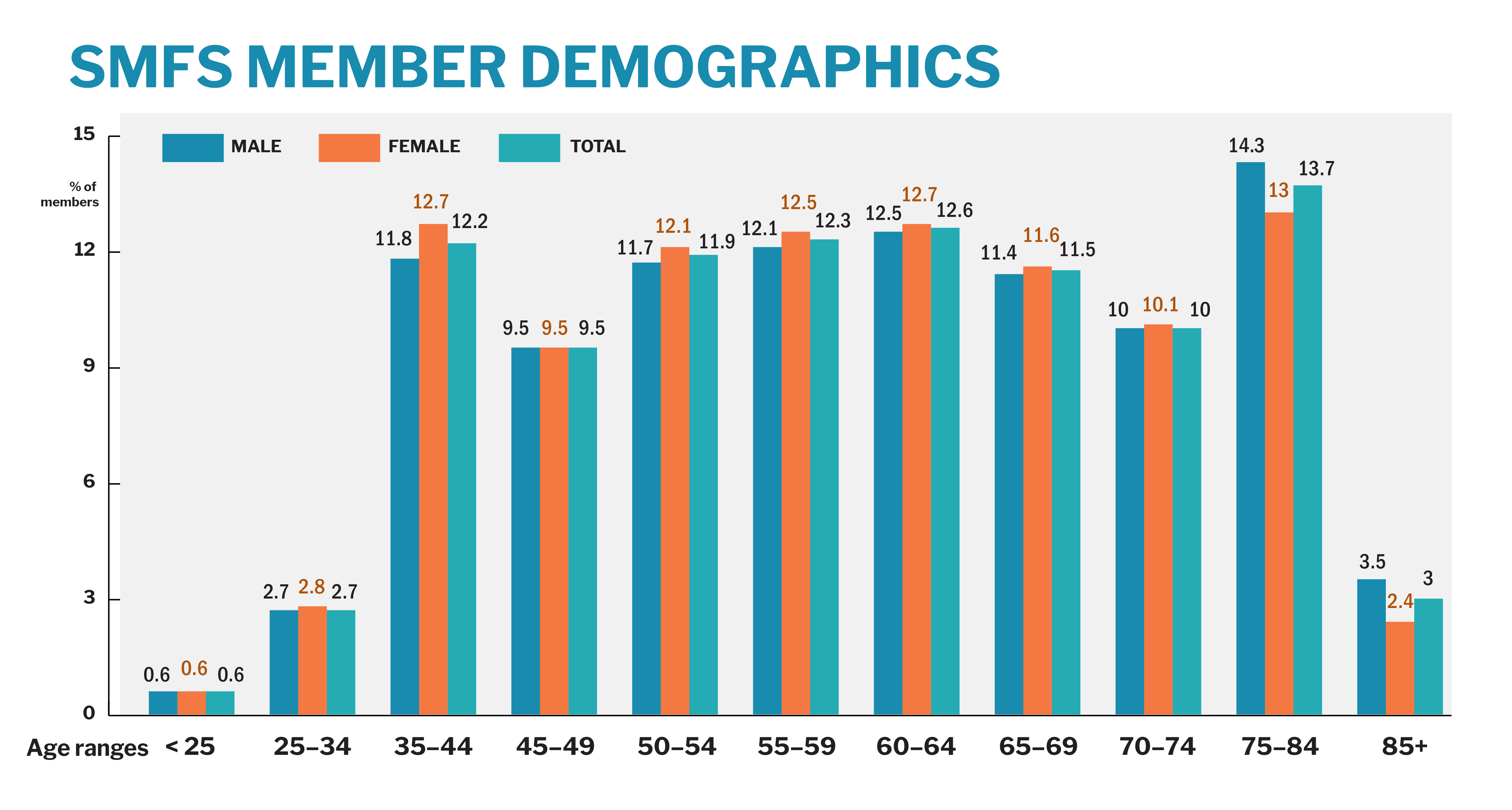

SMSF member demographics

Source: Australian Taxation Office SMSF Quarterly Statistical Report, June 2025

Industry experts

Property remains king

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

Firms

People

Copyright © 2025 KM Business Information Australia Pty Ltd

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

People

Firms

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

The professional network

Looking ahead

0.6%

2.7%

12.2%

9.5%

11.9%

12.3%

12.6%

11.5%

10.0%

13.7%

3.0%

Total

Male

Pepper Money is a people-focused non-bank, providing a refreshingly real-life approach to lending across home loans, commercial loans, equipment finance and car loans. We work with all sorts of people and businesses, from blue-collar to blue-chip. We take a uniquely flexible human approach, assessing each person’s situation individually. Since 2000, we have helped over 530,000 Australians achieve their financial goals. We’re consistently recognised as Australia’s leading non-bank lender, known for being broker-friendly with supportive and responsive BDMs, and offer a wide range of products that meet different customer needs – especially those of non-conforming and self-employed customers.

Find out more

The retreat of major banks from SMSF lending around 2018 wasn’t entirely surprising given their preference for standardised, high-volume products. This created space for non-bank lenders to establish themselves as specialists in a market that rewards expertise over scale.

Non-bank lenders can offer flexibility that larger institutions often can’t match. “We can look at diverse income sources – like self-employed borrowers – and tailor the paperwork around LRBA structures,” Chesworth says. “Big banks usually focus on standard, cookie-cutter profiles, so when it comes to SMSF loans that need a bit more flexibility, non-banks are often the better fit, while still keeping things responsible and compliant.”

The sector continues to evolve, with new opportunities emerging for brokers who can adapt.

“With interest rates easing and more lenders in the mix, brokers can help clients refinance and could unlock meaningful savings for their SMSF borrowing,” Saoud says. “We’re also seeing steady growth in SMSFs overall … [With] more Australians setting up SMSFs each year, property investment through SMSFs is likely to continue rising.”

The early boomers may have built the foundation, but it’s their children who are scaling it. With more than $70 billion already tied up in LRBAs, and trillions in total assets, the next growth wave won’t be about whether SMSFs borrow but how quickly younger trustees redefine the game.

Homeownership is a fundamental part of the Australian dream. However, the path can be challenging, especially when traditional lending is strict and unforgiving. We’re here to change that. Since 2000, Bluestone Home Loans has been helping borrowers with complex or unique financial situations access the market with confidence, offering them a chance to purchase property – when others won’t – by providing tailored lending solutions. We empower brokers to serve a broader range of clients, from self-employed professionals to borrowers with past credit issues or those seeking niche lending options. With a 25-year legacy, Bluestone Home Loans has become a trusted leader in the Australian lending market, known for delivering innovative, flexible and straightforward solutions that break the mould of traditional lending.

Find out more

The flexibility extends to the assets financed, Saoud explains. “Because these investors often bring an entrepreneurial flair, many are even using SMSFs to buy commercial properties for lease to their own business, so we’ve made our policies broad enough to finance both residential and commercial assets under our SMSF lending,” he says.

He frames it as a deliberate response to market needs: “In short, the younger SMSF demographic wants control, speed and flexibility, and as a non-bank lender we’ve been quick to adapt our products to tick those boxes.”

The market opportunity remains substantial, with around 11% of SMSFs currently using LRBAs, according to the Council of Financial Regulators. This suggests significant room for growth as more trustees become comfortable with borrowing within their super structures.

One practical challenge that often catches brokers off guard is the time pressure inherent in property transactions. SMSF structures can add complexity to settlements, but market conditions rarely allow for extended time frames.

“When you have a customer who’s purchasing a property, the last thing you want to do is to have to say, ‘It’s through super, so maybe negotiate a longer settlement period’,” Chesworth says. “That could be the breaking point and set the course for the deal falling through, especially if they don’t have that luxury of time.”

This reality has pushed lenders such as Bluestone to streamline its processes, and brokers would do well to prepare their clients for the requirements ahead of property selection. The ability to deliver within standard settlement time frames has become a competitive advantage in the market.

Process improvements have become a competitive differentiator. “Brokers told us SMSF loans often felt slow and clunky – extra paperwork and limited lender support made the process frustrating,” Saoud says. “So we made applications easier. Brokers can submit SMSF deals digitally through ApplyOnline or manually if preferred. Submission options mean less disruption to their preferred workflow and more confidence in the process.”

The emphasis on compliance remains paramount throughout the process. Chesworth says, “It’s absolutely key to ensure SMSF loans are delivered within the compliant and reporting structure the ATO requires for SMSFs and their trustees.”

Cory Bannister

La Trobe Financial

Jason Azzopardi

Brighten

In Partnership with

Cory Bannister is senior vice president and chief lending officer at La Trobe Financial. Bannister has over 20 years’ experience in financial services and has held a number of positions across credit and distribution since joining the business in 2000. As CLO, Bannister is focused on managing substantial wholesale and retail investors. He holds diplomas in mortgage lending and business accounting and resides in Melbourne.

La Trobe Financial

Cory Banniser

Age ranges

Female

0.6%

2.8%

12.7%

9.5%

12.1%

12.5%

12.7%

11.6%

10.1%

13.0%

2.4%

0.6%

2.7%

11.8%

9.5%

11.7%

12.1%

12.5%

11.4%

10.0%

14.3%

3.5%

<25

25–34

35–44

45–49

50–54

55–59

60–64

65–69

70–74

75–84

85+

Source: Australian Taxation Office SMSF Quarterly Statistical Report, June 2025

Quarter

Limited recourse borrowing arrangements ($ billion)

70.53

68.92

68.09

67.94

67.16

68.62

67.28

66.17

64.71

57.43

57.43

59.12

61.42

65.68

63.64

60.87

Jun 2025

Mar 2025

Dec 2024

Sep 2024

Jun 2024

Mar 2024

Dec 2023

Sep 2023

Jun 2023

Mar 2023

Dec 2022

Sep 2022

Jun 2022

Mar 2022

Dec 2021

Sep 2021

LRBAs invested in SMSFs

Source: Australian Taxation Office SMSF Quarterly Statistical Report, June 2025