The problem with boxes

Non-bank lenders are reshaping Australian finance with speed, flexibility and alternative solutions for complex borrowers

More

THE AUSTRALIAN LENDING MARKET has a problem with boxes. Traditional banks have spent decades perfecting the art of categorising borrowers into neat, predictable segments. But the modern economy doesn’t fit neatly into boxes any more. Self-employed workers represent 15% of the workforce. Business owners juggle multiple income streams. Property investors seek creative structures that mainstream lenders simply won’t touch.

This is where non-bank lenders are carving out their territory. While the major banks retreat from complexity, alternative lenders are stepping forward with solutions designed for the messier realities of contemporary finance.

“Banks specialise in uniformity. Non-banks specialise in possibility,” says Cory Bannister, chief lending officer at La Trobe Financial. The company focuses on providing brokers with access to products that unlock a broader customer base, designing pathways that reflect diverse modern financial circumstances.

Traditional banks face institutional constraints that non-banks simply don’t encounter. “Non-bank lenders like MA Money are stepping up to meet the needs of borrowers who don’t fit inside a bank’s box,” says Tim Lemon, national sales manager at MA Money. Whether it’s self-employed borrowers lacking two years of tax returns or clients with bonus-heavy compensation structures, non-banks approach these scenarios with practical flexibility.

This growth reflects changing business needs and non-bank capabilities. “Non-bank lenders are setting themselves apart by offering faster, more flexible funding solutions tailored to the realities of SME cash flow – something that traditional banks can’t match,” says Rebecca del Rio, chief revenue officer at Bizcap.

As non-bank institutions have grown, some of the largest now operate at a scale similar to that of small banks in Australia. “We closed the first half of the year with $20 billion in assets under management, reinforcing our strong position in the market,” says Barry Saoud, general manager for mortgages and commercial at Pepper Money. The company’s Fixed Rate No Break Cost loans, SMSF options with minimal net asset requirements, and near prime solutions demonstrate how non-banks are meeting needs that banks often cannot address.

Non-banks are finding particular success in market segments that traditional banks have abandoned or approach cautiously. Self-managed super funds represent one such opportunity. “The SMSF market continues to grow, with many consumers wanting to take charge of their retirement savings by buying property rather than remaining invested in ASX 50 indices with industry super funds,” Azzopardi observes.

Brighten is launching an SMSF product later this year, recognising that the complexity traditionally associated with this market creates opportunities for lenders willing to provide education and support. “SMSF lending has a reputation as difficult to understand, which is exactly why Brighten’s ‘easy-to-deal-with’ approach will have extra value for brokers,” says Azzopardi.

At La Trobe Financial, Bannister says, “Whilst we too have been busily transforming our technology capability to accelerate our decision process – our latest being the launch of our own proprietary DigiApps online application software – we will always keep human judgement firmly at the heart of our assessment process.” The company maintains this balance as it views human assessment as essential in the complex prime market.

The technology doesn’t eliminate personal service – it redirects human attention towards higher-value activities. Del Rio explains: “Automation and open-banking integrations now remove large chunks of admin work, enabling BDMs to spend more time where they add the most value: scenario workshopping, getting creative with structure and being truly solutions-led.”

For brokers dealing with complex client situations, this combination proves particularly valuable. Tony MacRae, chief commercial officer at Bluestone Home Loans, describes the approach: “When assessing an application, it’s important to understand the story behind the numbers, as it provides our team with more context about the borrower’s situation and [helps us] find a suited solution.”

The most successful non-bank lenders are building technology platforms designed specifically for broker workflows, rather than adapting consumer-focused systems. “We’ve integrated NextGen’s ApplyOnline into our technology suite, giving brokers a more intuitive loan submission process and reducing application times by an average of 30 minutes,” says Azzopardi.

The goal isn’t just digitisation – it’s removing friction from broker processes. MacRae notes that this approach requires understanding broker needs: “Brokers seek out lenders who can adapt to real-world borrower profiles and provide consistent support throughout the application process.”

Pepper Money has developed similar solutions that streamline the adviser experience. “Tools like our Pepper Product Selector give brokers indicative rates and repayments in minutes,” says Saoud. The company provides direct access to its credit team, enabling advisers to find tailored solutions quickly and support more clients effectively.

The rise of alternative employment arrangements has created a documentation mismatch between how people earn money and how banks verify income. Non-banks are responding with flexible documentation requirements that reflect modern work patterns.

“At MA Money, we accept 100% of bonus income, up to 90% of rental income, and support alternative-documentation loans for self-employed customers,” says Lemon. This flexibility expands serviceability options, which is particularly important in higher interest rate environments where borrowing capacity has tightened.

La Trobe Financial is Australia’s leading alternative asset manager and a trusted investment partner for both institutional and retail investors, with over A$20 billion in assets under management. We proudly serve more than 110,000 investors – including some of the world’s largest financial institutions – and collaborate with over 4,500 financial advisers across the country. With a legacy spanning over 70 years, our real estate credit finance business has been helping Australians navigate complex financial needs through tailored lending solutions. We offer an unmatched product suite and loan sizes of up to $40 million, covering residential, commercial and development finance.

Find out more

In Partnership with

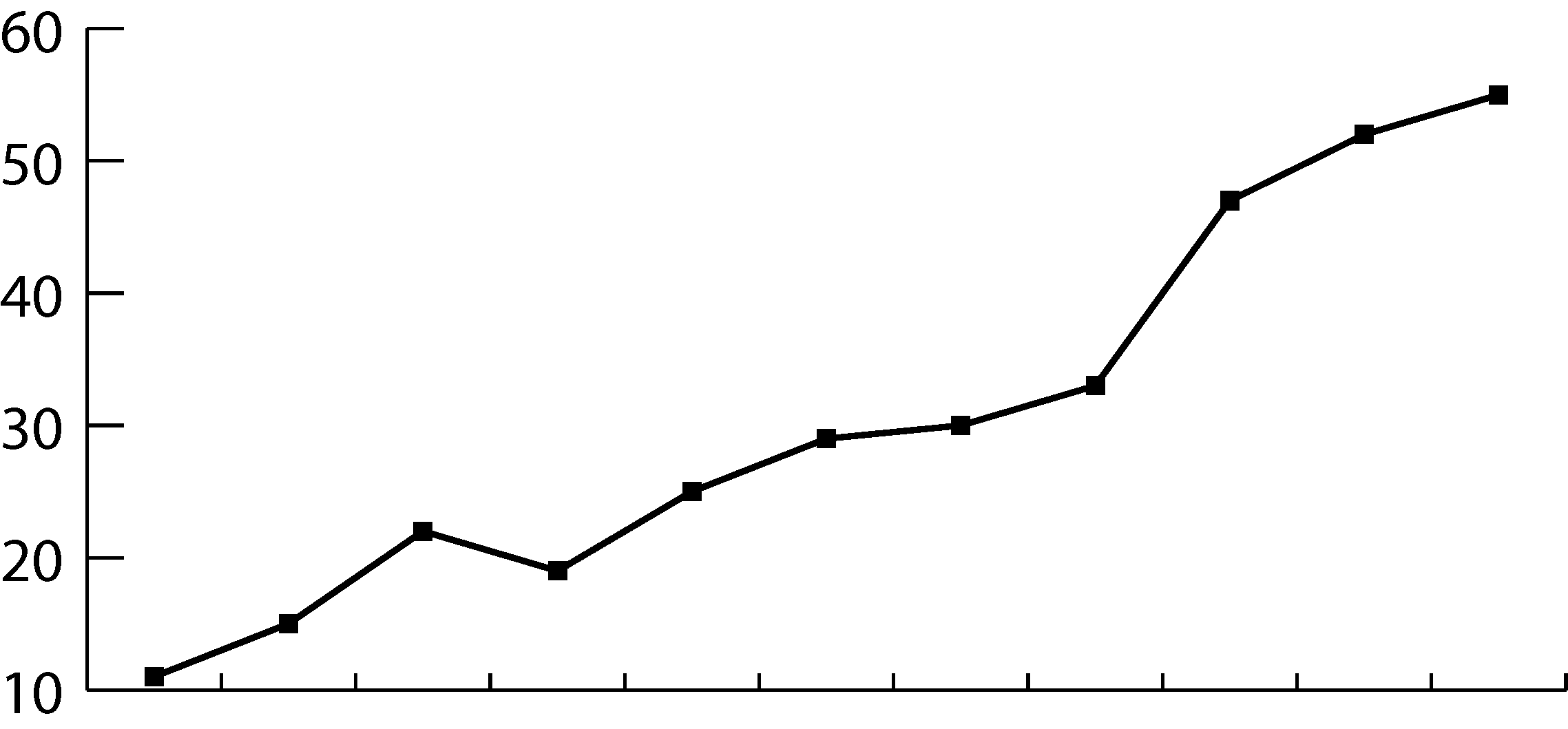

The numbers tell a compelling story. Non-banks’ share of housing credit sits around 4% as of January 2025, while their share of business credit reaches approximately 11%. More telling is the trajectory in SME lending intentions: 55% of small businesses now consider non-bank borrowing for growth funding, up from just 11% in 2014.

Several key trends are emerging in borrower demand. “There is a notable increase in borrowers adopting proactive strategies to leverage emerging opportunities as conditions improve in both property markets and broader business investments,” says Bannister. La Trobe Financial has observed rising demand for equity access for investment; recovery in commercial property investment; and improvement in construction activity as supply challenges create long-term growth prospects.

Jason Azzopardi has over 25 years of experience in finance in both Australia and London. Prior to joining Brighten as CEO, Azzopardi was the CFO at ASX-listed non-bank lender Resimac, concurrently holding additional roles that included leading Resimac’s Manila operations and managing Resimac NZ as CEO. Previously, he held key senior roles at Bankwest, Macquarie Bank and within private equity in the UK, namely at Fortress and 3i. Azzopardi is a respected financial services leader who has successfully implemented strategic initiatives across multiple disciplines, including finance, treasury, distribution, operations, data and business intelligence, brand and customer experience. Azzopardi is a fellow of CPA Australia and a graduate of the Australian Institute of Company Directors.

Brighten

Jason Azzopardi

Share

Share

Share

Jason Azzopardi

Brighten

Industry experts

Cory Bannister is senior vice president and chief lending officer at La Trobe Financial. Bannister has over 20 years’ experience in financial services and has held a number of positions across credit and distribution since joining the business in 2000. As CLO, Bannister is focused on managing substantial wholesale and retail investors. He holds diplomas in mortgage lending and business accounting and resides in Melbourne.

La Trobe Financial

Cory Bannister

Jason Azzopardi has over 25 years of experience in finance in both Australia and London. Prior to joining Brighten as CEO, Azzopardi was the CFO at ASX-listed non-bank lender Resimac, concurrently holding additional roles that included leading Resimac’s Manila operations and managing Resimac NZ as CEO. Previously, he held key senior roles at Bankwest, Macquarie Bank and within private equity in the UK, namely at Fortress and 3i. Azzopardi is a respected financial services leader who has successfully implemented strategic initiatives across multiple disciplines, including finance, treasury, distribution, operations, data and business intelligence, brand and customer experience. Azzopardi is a fellow of CPA Australia and a graduate of the Australian Institute of Company Directors.

Brighten

Jason Azzopardi

While automation drives efficiency, non-bank lenders are discovering that technology works best when it enhances rather than replaces human judgement. “We intentionally retain a human in the loop at every stage of credit assessment to ensure we make well-rounded, pragmatic decisions,” says del Rio.

This hybrid approach allows non-banks to handle complexity that would stump automated systems. Jason Azzopardi, chief executive at Brighten, emphasises the value of experienced assessment: “Our experienced Sydney-based credit team takes a manual approach to assessment. This allows us to consider each application on its merits and better serve borrowers with diverse situations.”

“When assessing an application, it’s important to understand the story behind the numbers, as it provides our team with more context about the borrower’s situation and [helps us] find a suited solution”

Tony MacRae,

Bluestone Home Loans

In business lending, time often matters more than price. “We can provide offers without credit checks, we approve deals in as little as three hours, and we can fund on the same day,” says del Rio. Bizcap has built its reputation on velocity, recognising that small and medium enterprises often need capital faster than banks can move.

Modern brokers are positioning themselves as comprehensive finance partners rather than single-product specialists. Del Rio notes that speed enables broader relationships: “We’re seeing brokers reposition themselves away from being just ‘mortgage brokers’ and instead branding themselves as full-spectrum finance partners.”

The technological foundation supporting this speed has become increasingly sophisticated. “We launched the Cinch platform this year, and it has transformed loan origination at MA Money,” says Lemon. The system has doubled the company’s assessment capacity without compromising quality, demonstrating how purpose-built technology can outperform legacy banking systems.

The alt-doc market represents a significant opportunity. “At Brighten, for example, our competitive alt-doc offering gives brokers more ways to support clients who fall outside standard bank criteria,” says Azzopardi. The company has extended these options across construction, vacant land and bridging loans, requiring just one form of income documentation.

Self-employed clients present particular challenges that non-banks are uniquely positioned to address. “Self-employed clients need different ways to verify income,” says Saoud. “That’s where AltDoc Xpress comes in.” Pepper Money’s AltDoc Xpress accelerates the process of completing the Declaration of Financial Position and Accountant’s Letter digitally, with loans available up to $2.5 million at competitive rates.

Cory Bannister is senior vice president and chief lending officer at La Trobe Financial. Bannister has over 20 years’ experience in financial services and has held a number of positions across credit and distribution since joining the business in 2000. As CLO, Bannister is focused on managing substantial wholesale and retail investors. He holds diplomas in mortgage lending and business accounting and resides in Melbourne.

La Trobe Financial

Cory Bannister

Jason Azzopardi has over 25 years of experience in finance in both Australia and London. Prior to joining Brighten as CEO, Azzopardi was the CFO at ASX-listed non-bank lender Resimac, concurrently holding additional roles that included leading Resimac’s Manila operations and managing Resimac NZ as CEO. Previously, he held key senior roles at Bankwest, Macquarie Bank and within private equity in the UK, namely at Fortress and 3i. Azzopardi is a respected financial services leader who has successfully implemented strategic initiatives across multiple disciplines, including finance, treasury, distribution, operations, data and business intelligence, brand and customer experience. Azzopardi is a fellow of CPA Australia and a graduate of the Australian Institute of Company Directors.

Brighten

Jason Azzopardi

Barry Saoud joined Pepper Money in July 2021 as general manager, mortgages and commercial lending and is responsible for its strategic direction and operating performance across sales, product, credit and operations functions for Australia and New Zealand mortgages, commercial loans, personal loans and direct sales. With over two decades’ experience in financial services, he has held numerous roles across areas ranging from legal to company secretary, sales and product management at the likes of Aussie (Home Loans), GE Capital, HSBC and Norton Rose Fulbright. He is a passionate leader with proven ability to grow businesses and exceed targets.

Pepper Money

Barry Saoud

“Non-bank lenders are setting themselves apart by offering faster, more flexible funding solutions tailored to the realities of SME cash flow – something that traditional banks can’t match”

Rebecca del Rio, Bizcap

Market share and growth trajectory

Speed becomes currency

Published 22 Sep 2025

Cory Bannister

La Trobe Financial

Brighten is an Australian owned, based and regulated non-bank lender with offices in Sydney, Melbourne, Brisbane, Hong Kong, Shanghai and Manila. Brighten is a full-service non-bank lender, responsible for the origination, underwriting, servicing and funding of its mortgage portfolio. It has well-established warehouse funding arrangements with multiple top-tier banks, three public RMBS programs and a wholesale credit fund to provide further funding diversification. Brighten offers a range of competitive full-doc, alt-doc, expat, non-resident, bridging, construction and commercial products to borrowers.

Find out more

Commercial lending is another growth area. “Non-banks like Bluestone are well-positioned to support a wide range of creditworthy clients, including those with irregular income streams, self-employed borrowers or individuals seeking alternative-documentation options,” says MacRae.

Non-banks are expanding into the commercial space, filling gaps left by major banks that have tightened their appetite for business lending. The growth in specialist lending creates financial inclusion for borrowers who fall outside traditional lending criteria. “We’ve already supported more than 84,700 specialist customers – and that number’s still rising,” says Saoud. Whether it’s self-employed clients, borrowers with complex income structures or those with imperfect credit histories, specialist loans provide essential access to finance.

The human touch in digital finance

Risk assessment beyond the algorithm

Non-bank market share by sector

Source: Reserve Bank of Australia Financial Stability Review, April 2025

Industry experts

Addressing the documentation dilemma

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

Firms

People

Copyright © 2025 KM Business Information Australia Pty Ltd

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

Advertising

Authors

E-newsletter

Contact Us

Contact Us

Australian Mortgage Awards

Events

White papers

Webinar

Australian Broker Talk

Resources

TV

Sector Focus

Power Panel

Independent Feature

Executive Team Profile

Exclusive Leader Profile

Business Update

Business Focus

Big Deal

Premium Content

Technology

Reverse Mortgages

Investment Loans

Specialist Lending

SME

Commercial

Speciality

Best In Mortgage

News

News

Copyright © 2025 KM Business Information Australia Pty Ltd

RSS

Sitemap

About us

Conditions of Use

Privacy policy

Terms & conditions

People

Firms

RSS

Sitemap

About us

Conditions of Use

Cookie Policy

Privacy policy

Terms & conditions

People

Firms

Source: ScotPac bi-annual SME Growth Index

50

40

30

20

10

2014 (Sep)

2015 (Sep)

2018 (Mar)

2019 (Sep)

2020 (Nov)

2021 (Sep)

2022 (Apr)

2022 (Sep)

2023 (Mar)

2024 (Mar)

%

Specialised lending markets

Overcoming perception challenges

Rebecca del Rio

Bizcap

Barry Saoud

Pepper Money

Tony MacRae

Bluestone Home Loans

Tim Lemon

MA Money

Tim Lemon, who joined MA Money in October 2023, brings over 20 years of finance industry expertise to his role as national sales manager. Lemon’s career is defined by his talent for finding out-of-the-box lending solutions benefiting both brokers and their clients. His extensive experience in business development at non-bank lenders underscores his ability to navigate complex financial landscapes.

MA Money

Tim Lemon

Rebecca del Rio is chief revenue officer at Bizcap and was the company’s fourth employee when she joined in 2019. Since then, she has played a pivotal role in scaling Bizcap from a local startup into a global non-bank lender with more than 180 staff across five countries. A senior leader with deep expertise in sales/partnerships strategy, marketing, people and revenue growth, she is passionate about helping brokers support their SME clients with fast, flexible funding. Del Rio is known for her strategic vision and her ability to drive global growth while strengthening Bizcap’s position in the Australian broker market.

Bizcap

Rebecca del Rio

Barry Saoud joined Pepper Money in July 2021 as general manager, mortgages and commercial lending and is responsible for its strategic direction and operating performance across sales, product, credit and operations functions for Australia and New Zealand mortgages, commercial loans, personal loans and direct sales. With over two decades’ experience in financial services, he has held numerous roles across areas ranging from legal to company secretary, sales and product management at the likes of Aussie (Home Loans), GE Capital, HSBC and Norton Rose Fulbright. He is a passionate leader with proven ability to grow businesses and exceed targets.

Pepper Money

Barry Saoud

Tony MacRae stepped into the role of chief commercial officer at Bluestone in August 2023, bringing with him a wealth of experience in financial services. He spent a decade at Westpac Group, where he served as acting CEO of RAMS and led third party distribution at Westpac. Known throughout the industry for his ability to drive sales initiatives and strategic direction, MacRae excels at building partnerships and leading teams towards impressive business growth. At Bluestone, he is focused on empowering the company’s broker partners to better serve customers. In addition to his work at Bluestone, MacRae has dedicated the last 11 years to the Royal Flying Doctors Service South Eastern Section as a board member and treasurer. He holds a Bachelor of Economics from Macquarie University.

Bluestone Home Loans

Tony MacRae

Year to Jan 2025

~4%

~11%

Non-bank share of business credit

Non-bank share of housing credit

Pepper Money is a people-focused non-bank providing a refreshingly real-life approach to lending across home loans, commercial loans, equipment finance and car loans. We work with all sorts of people and businesses, from blue-collar to blue-chip. We take a uniquely flexible human approach, assessing each person’s situation individually. Since 2000, we have helped over 530,000 Australians achieve their financial goals. We’re consistently recognised as Australia’s leading non-bank lender known for being broker-friendly with supportive and responsive BDMs, and we offer a wide range of products that meet different customer needs – especially for non-conforming and self-employed customers.

Find out more

While banks increasingly rely on automated credit scoring and debt-to-income ratios, non-banks are taking a more contextual approach to risk assessment. “At MA Money, we don’t use credit scoring, DTI limits or comprehensive credit reporting to auto-decline applications,” says Lemon. Instead, each application receives assessment from an experienced credit professional with discretion to look deeper.

“Complexity is too often treated as a stop sign; at La Trobe we treat it as an opportunity,” Bannister says. The company targets the ‘complex prime borrower’ market, where a late telco payment doesn’t cancel out years of strong financial behaviour, nor does irregular income overwrite the stability of a successful business.

This approach benefits brokers working with clients who have complex financial profiles. “We actively encourage brokers to bring us scenarios others won’t look at,” says del Rio. “Being privately owned and funded gives us the ability and appetite to push outside standard rules if a deal makes sense.”

“At MA Money, we accept 100% of bonus income, up to 90% of rental income, and support alternative- documentation loans for self-employed customers”

TIM LEMON,

MA MONEY

At MA Money, we believe in doing things differently. As one of Australia’s fastest-growing non-bank lenders, we provide tailored property loan solutions for borrowers who need flexibility and a personalised approach. Backed by MA Financial, we bring a unique combination of stability, scale and service excellence to help our customers and brokers achieve their goals.

Find out more

“At Pepper Money, we assess credit with flexibility and a real-life lens. We consider clients with complex or

non-standard profiles like the self-employed or those with credit issues”

BARRY SAOUD,

PEPPER MONEY

“According to brokers, a key strength of our operations is the consistency of our credit approach and the availability of products throughout different market cycles,” says Bannister. La Trobe Financial has refined its policies over seven decades to maintain a broad product offering across varying market conditions, including investor, self-employed, SMSF, development, commercial and residential options.

Despite growing market share, non-bank lenders continue facing perception challenges among both brokers and borrowers.

“Much work has been done over many years by lenders, industry, aggregators and brokers to remove any misconceptions about non-bank lenders and the role they play in the financial economy, to the extent that today we would expect that all successful brokers would be dealing with a non-bank alternative on a regular basis,” says Bannister. La Trobe Financial believes mature non-bank businesses have broad product ranges that are highly relevant to brokers and their clients, often superior to bank offerings.

Education plays a key role in addressing these concerns. Lemon says, “The most common myth is that non-banks are only for borrowers with poor credit. In reality, non-banks are often the best choice for borrowers with complex income, multiple assets or who simply don’t fit the bank’s model.”

The funding misconception represents another challenge, as del Rio points out. “One of the biggest misconceptions in the market is around the term ‘privately funded’. Brokers who understand what it really means see it as a competitive advantage, faster approvals, flexible thinking and a greater willingness to back strong deals.”

The regulatory environment provides additional support. “Consumers have the same protections as they would sourcing a loan from a bank,” Azzopardi says. “The standards under which we all operate are set out in the National Consumer Credit Protection Act, and they’re overseen by ASIC.”

60

2025 (Apr)

11%

15%

22%

19%

25%

29%

30%

33%

47%

52%

55%

Proportion of SMEs intending to fund new growth using non-banks

Building broker confidence

Successful non-banks are investing heavily in broker education and support. “At MA Money, we invest in helping brokers understand our credit appetite so they can educate their clients with confidence,” says Lemon.

This educational approach recognises that brokers need to feel confident recommending non-bank solutions to their clients. MacRae says, “Staying informed about the latest product offerings and understanding the types of scenarios non-banks can support empowers brokers to confidently present more options to their clients.”

Bannister says “the biggest challenge brokers face isn’t finding clients; it’s finding solutions”. La Trobe Financial supports brokers with direct access to assessors and credit-skilled BDMs, offering more solutions and greater flexibility than other lenders in the segment.

Non-banks’ support extends to ongoing relationship management. MacRae emphasises the collaborative nature of this approach: “Brokers are facing rising expectations from borrowers who want fast, flexible and personalised lending solutions. With the market constantly evolving, brokers must stay informed and be across more than just the major banks.”

“The biggest challenge brokers face isn’t finding clients; it’s finding solutions”

CORY BANNISTER, LA TROBE FINANCIAL

Homeownership is a fundamental part of the Australian dream. However, the path can be challenging, especially when traditional lending can be strict and unforgiving. Bluestone Home Loans is here to change that. Since 2000, the company has been helping borrowers with complex or unique financial situations access the market with confidence, offering them a chance to purchase property – when others won’t – by providing tailored lending solutions. We empower brokers to serve a broader range of clients, from self-employed professionals to borrowers with past credit issues or those seeking niche lending options. With a 25-year legacy, Bluestone Home Loans has become a trusted leader in the Australian lending market, known for delivering innovative, flexible and straightforward solutions that break the mould of traditional lending.

Find out more

Bluestone has developed an education-first approach that helps brokers understand alternative lending options and position them effectively to their clients.

Pepper Money similarly emphasises the importance of long-term relationships that go beyond individual transactions. “Pepper Money’s approach to specialist lending extends beyond individual transactions to building relationships that endure over time,” says Saoud. The company’s local customer service team supports clients throughout their lending journey, not just during the application process.

Modern non-banks operate with sophisticated funding arrangements. “At Brighten we believe our strong capital base and funding arrangements are a point of difference,” says Azzopardi. “We have well-established warehouse funding arrangements with multiple top-tier banks, three public RMBS programs and multiple wholesale credit funds to provide further funding diversification.”

This funding diversity allows non-banks to maintain competitive pricing while offering flexibility that traditional banks cannot match due to their institutional constraints.

Capital and funding sophistication

“SMSF lending has a reputation as difficult to understand, which is exactly why Brighten’s ‘easy-to-deal-with’ approach will have extra value for brokers”

Jason Azzopardi, Brighten

The scale of modern non-banks often surprises brokers. “Bizcap is sometimes assumed to be a small niche player due to our speed and nimbleness, when in reality we are one of the most active lenders in the market,” says del Rio. “We have a team of more than 180 people and approve and fund over $140 million per month globally.”

As traditional banks continue retreating from complex lending scenarios, non-banks are positioning themselves not as alternative lenders but as primary solutions for modern finance needs. The question isn’t whether non-banks will continue growing – it’s how quickly brokers and borrowers will recognise that sometimes the best box is no box at all.

Bizcap is the most open-minded lender in Australia, dedicated to empowering small to medium enterprises with fast access to flexible loans. We can approve loans of $500,000 to $5 million in as little as three hours without upfront credit checks and fund them in as little as 24 hours. Since the company’s inception in 2019, Bizcap has empowered SMEs with over 23,000 business loans totalling more than $1 billion, while retaining a 4.9/5 Trustpilot rating. With our award-winning products and customer service, we are one of the foremost fintechs in our field.

Find out more

Pepper Money takes a similarly flexible approach to credit assessment. “At Pepper Money, we assess credit with flexibility and a real-life lens,” says Saoud. “We consider clients with complex or non-standard profiles like the self-employed or those with credit issues.” The company accepts full-doc or alt-doc income verification, including BAS (business activity statements) and business bank statements, providing options for borrowers who don’t fit traditional criteria.

The flexibility extends to borrowers recovering from financial setbacks. Rather than automatic exclusions based on credit events, non-banks often consider the circumstances and recovery trajectory. This nuanced approach opens opportunities for brokers dealing with clients who have overcome temporary financial difficulties.

Non-banks are differentiating themselves through broker support models that prioritise accessibility over volume requirements. “There are no volume tiers, exclusivity clubs or channel conflict,” says Lemon about MA Money’s approach. “Every broker, no matter how many loans they write, gets direct access to a dedicated BDM.”

This egalitarian approach extends to specialised support services. “We’ve also introduced a scenario specialist to workshop deals pre-submission – this has led to stronger applications and improved approval rates,” says Lemon.

SMEs INCREASINGLY LOOKING TO

NON-BANKS FOR FUNDING

Bluestone has also seen an uptick from brokers on similar products. “We have seen strong engagement from brokers on our alt-doc home loans, which support creditworthy borrowers who may not have full financials or standard income documentation,” says MacRae.

Barry Saoud

Pepper Money

Tony MacRae

Bluestone Home Loans

Tim Lemon

MA Money

Rebecca del Rio

Bizcap

Cory Bannister

La Trobe Financial

Jason Azzopardi

Brighten

In Partnership with

Rebecca del Rio is chief revenue officer at Bizcap and was the company’s fourth employee when she joined in 2019. Since then, she has played a pivotal role in scaling Bizcap from a local startup into a global non-bank lender with more than 180 staff across five countries. A senior leader with deep expertise in sales/partnerships strategy, marketing, people and revenue growth, she is passionate about helping brokers support their SME clients with fast, flexible funding. Del Rio is known for her strategic vision and her ability to drive global growth while strengthening Bizcap’s position in the Australian broker market.

Bizcap

Rebecca del Rio

Barry Saoud joined Pepper Money in July 2021 as general manager, mortgages and commercial lending and is responsible for its strategic direction and operating performance across sales, product, credit and operations functions for Australia and New Zealand mortgages, commercial loans, personal loans and direct sales. With over two decades’ experience in financial services, he has held numerous roles across areas ranging from legal to company secretary, sales and product management at the likes of Aussie (Home Loans), GE Capital, HSBC and Norton Rose Fulbright. He is a passionate leader with proven ability to grow businesses and exceed targets.

Pepper Money

Barry Saoud

Tony MacRae stepped into the role of chief commercial officer at Bluestone in August 2023, bringing with him a wealth of experience in financial services. He spent a decade at Westpac Group, where he served as acting CEO of RAMS and led third party distribution at Westpac. Known throughout the industry for his ability to drive sales initiatives and strategic direction, MacRae excels at building partnerships and leading teams towards impressive business growth. At Bluestone, he is focused on empowering the company’s broker partners to better serve customers. In addition to his work at Bluestone, MacRae has dedicated the last 11 years to the Royal Flying Doctors Service South Eastern Section as a board member and treasurer. He holds a Bachelor of Economics from Macquarie University.

Bluestone Home Loans

Tony MacRae

Tim Lemon, who joined MA Money in October 2023, brings over 20 years of finance industry expertise to his role as national sales manager. Lemon’s career is defined by his talent for finding out-of-the-box lending solutions benefiting both brokers and their clients. His extensive experience in business development at non-bank lenders underscores his ability to navigate complex financial landscapes.

MA Money

Tim Lemon

Tony MacRae stepped into the role of chief commercial officer at Bluestone in August 2023, bringing with him a wealth of experience in financial services. He spent a decade at Westpac Group, where he served as acting CEO of RAMS and led third party distribution at Westpac. Known throughout the industry for his ability to drive sales initiatives and strategic direction, MacRae excels at building partnerships and leading teams towards impressive business growth. At Bluestone, he is focused on empowering the company’s broker partners to better serve customers. In addition to his work at Bluestone, MacRae has dedicated the last 11 years to the Royal Flying Doctors Service South Eastern Section as a board member and treasurer. He holds a Bachelor of Economics from Macquarie University.

Bluestone Home Loans

Tony MacRae

Tim Lemon, who joined MA Money in October 2023, brings over 20 years of finance industry expertise to his role as national sales manager. Lemon’s career is defined by his talent for finding out-of-the-box lending solutions benefiting both brokers and their clients. His extensive experience in business development at non-bank lenders underscores his ability to navigate complex financial landscapes.

MA Money

Tim Lemon

Rebecca del Rio is chief revenue officer at Bizcap and was the company’s fourth employee when she joined in 2019. Since then, she has played a pivotal role in scaling Bizcap from a local startup into a global non-bank lender with more than 180 staff across five countries. A senior leader with deep expertise in sales/partnerships strategy, marketing, people and revenue growth, she is passionate about helping brokers support their SME clients with fast, flexible funding. Del Rio is known for her strategic vision and her ability to drive global growth while strengthening Bizcap’s position in the Australian broker market.

Bizcap

Rebecca del Rio

Cory Bannister is senior vice president and chief lending officer at La Trobe Financial. Bannister has over 20 years’ experience in financial services and has held a number of positions across credit and distribution since joining the business in 2000. As CLO, Bannister is focused on managing substantial wholesale and retail investors. He holds diplomas in mortgage lending and business accounting and resides in Melbourne.

La Trobe Financial

Cory Banniser